(Kitco News) – Wall Street and Main Street both look for gold’s newfound upward momentum to continue next week, based on the Kitco News gold survey.

Equities sold off sharply Wednesday and Thursday. Even though the stock market was up Friday morning, the prior weakness left gold higher for the week as investors turned to the metal as a safe haven. The dollar index also eased this week, further fueling gold’s ascent.

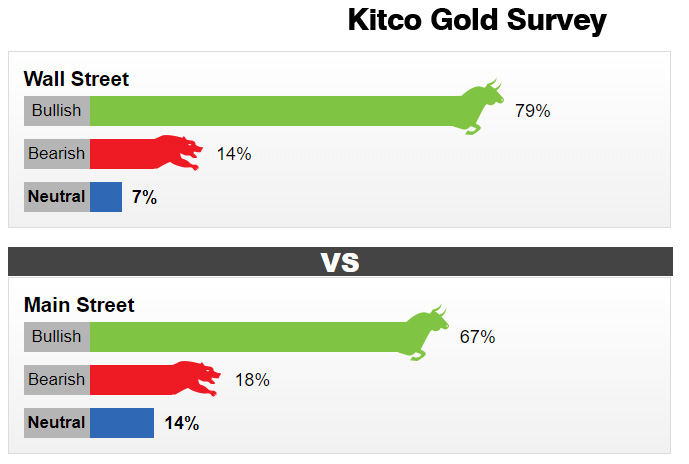

Fourteen market professionals took part in the Wall Street survey. Eleven respondents, or 79%, predicted higher prices by next Friday. There were two votes, or 14%, calling for lower prices, while one respondent, or 7%, looked for a sideways market.

Meanwhile, 527 people responded to an online Main Street poll. A total of 355 respondents, or 67%, called for gold to rise. Another 99, or 18%, predicted gold would fall. The remaining 73 voters, or 14%, see a sideways market.

For the trading week now winding down, 56% of Wall Street voters and 51% of those on Main Street were bullish. As of 11:02 a.m. EDT, they were right. Comex December gold was up 1.2% for the week so far to $1,220.10 an ounce.

Kevin Grady, president of Phoenix Futures and Options LLC, flipped from bearish to bullish for the week ahead.

“Gold broke out of some key technical levels yesterday,” Grady said. “This morning’s prelim[inary] open interest is showing 27,000 new longs [bullish traders] in the market. I am a little bullish for the coming week because I think you should see some more short covering as well as new longs entering the market.”

Ken Morrison, editor of the newsletter Morrison on the Markets, also looks for more upside, describing Thursday’s biggest daily price gain of the year as a “huge day for gold.” Further, the metal closed above resistance at $1,220, where recent rallies have stalled.

“Importantly it did so on the highest volume since June with open interest rising nearly 30,000 contracts, indicating new buyers dominated the flow,” Morrison said. “It’s important to keep in mind managed funds entered the week near a record net-short. The big jump in open interest indicates they were not actively covering positions….I expect gold aims for near $1,240 over the next week.”

Adrian Day, chairman and chief executive officer of Adrian Day Asset Management, also said higher.

“With bonds, equities, and the dollar down, this is a perfect environment for some investors to buy gold as a hedge,” he said. “Of course, we expect some recovery in the markets next week, which may see gold give back some of its gains, but it has bottomed.”

Two Kitco participants in the poll had mixed views. Jim Wyckoff, senior technical analyst, said he foresees more strength since “charts have turned way more friendly.”

However, Peter Hug, global trading director of Kitco Metals, was one of two survey participants who see a potential for a modest price pullback over the next week.

“If we can create some stability in the equity markets, I would expect a modestly stronger dollar, which should create a small bias to the downside for gold,” he said.

By Allen Sykora

For Kitco News

Contact asykora@kitco.com