(Kitco News) – Wall Street looks for gold’s downward momentum to continue next week, while Main Street voters are in a near dead heat on whether gold will rise or fall.

After hovering around $1,200 an ounce for several weeks, gold turned south again this week after the Federal Open Market Committee not only hiked interest rates by another 25 basis points but appeared to remain hawkish for the foreseeable future. This boosted the U.S. dollar, with the greenback also getting a lift against the euro from budget uncertainties in Italy.

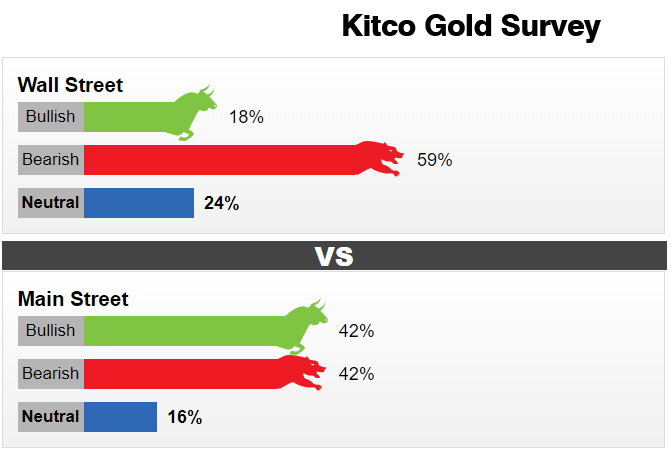

Seventeen market professionals took part in the Wall Street survey. Eleven respondents, or 59%, predicted lower prices by next Friday. There were three votes, or 18%, calling for higher prices, while four respondents, or 24%, were neutral or looked for a sideways market.

Meanwhile, 549 people responded to an online Main Street poll. A total of 233 respondents, or 42%, called for gold to rise. Another 230, also 42%, predicted gold would fall. The remaining 86 voters, or 16%, see a sideways market.

For the trading week now winding down, 72% of Wall Street voters and 57% of Main Street respondents were bullish. As of 11:13 a.m. EDT, Comex December gold was down 0.5% for the week so far to $1,195 an ounce.

“We’re looking for a break lower to the downside,” said Ralph Preston, principal with Heritage West Financial.

Phil Flynn, senior market analyst with at Price Futures Group, said gold remains vulnerable.

“Gold can’t get a break,” Flynn said. “Even with the expected Fed rate hike, the dollar soared on strong U.S. economic data. The [gold] market broke out to the downside, leaving it vulnerable for further losses next week.”

Kevin Grady, president of Phoenix Futures and Options LLC, sees potential for December gold to retest the August lows below $1,168 an ounce. He cites the combination of tightening of monetary policy by the Federal Reserve and 10-year Treasury yields above 3% re-exerting pressure on gold after the metal seemed to find “fair value” for a while near the $1,200 area.

“Every time the market tries to rally, there is selling above the market,” Grady said. “Gold is having a hard time….I think the bears are in control and we’re going to test those lows.”

Independent technical analyst Darin Newsom also sees a retest of last month’s lows.

“December gold moved to a new four-week low of $1,184.30 (so far) this week,” Newsom said

Friday morning. “That opens the door to test the previous low of $1,167.10.”

Mark Leibovit, editor of the VR Gold Letter, sees gold under $1,172, commenting: “I am a bear.”

Meanwhile, George Gero, managing director with RBC Wealth Management, looks for gold to bounce next week since the “negatives [are] already priced in,” with potential for short covering and bargain hunting.

“I have just switched from bearish to bullish on gold for next week,” said Colin Cieszynski, chief market strategist at SIA Wealth Management. “Gold had been dropping but has bounced back nicely this morning. The Fed meeting is over, and U.S. Treasury yields are easing back, so the USD should as well, taking some of the pressure off gold. I think a gain would be more of a trading bounce, however, with resistance possible near $1,200 or $1,220.”

An Australian reader named Robert predicted that gold will rise $20 in the coming week, perhaps testing resistance at $1,220. Longer term, “buckle up and enjoy the ride to $1,350!” he said.

”Only last month have we had 2018 lows for gold, and then on the back of some dovish comments last week from Fed Chair [Jerome] Powell, it rose $20 alone, suggesting it is massively, and I stress ‘massively,’ oversold. Gold has seen its bottom.”

Sean Lusk, director of commercial hedging Walsh Trading, said he is neutral for the next week but bullish for the longer term. After noting that gold is down approximately 10% for the year, he commented that eventually, the break below $1,200 should attract some bargain hunting and profit-taking by traders with short, or bearish, positions.

“What is going to take funds and the trade overall to establish longer-term gold positions?” he asked rhetorically. He later added, “We’re looking for dips to get long [buy] again.”

Ole Hansen, head of commodity strategy at Saxo Bank, also said he is neutral on gold in the near term. Despite the latest selling pressure, he noted that gold is still within its recent range and it could remain stuck there as investors see little immediate need for safe-haven assets.

“The U.S. economy remains strong, and that is supporting the U.S. dollar and equity markets. Investors don’t see the need to build a rainy-day fund as markets are pretty much behaving themselves,” Hansen said.

By Allen Sykora

For Kitco News

Contact asykora@kitco.com