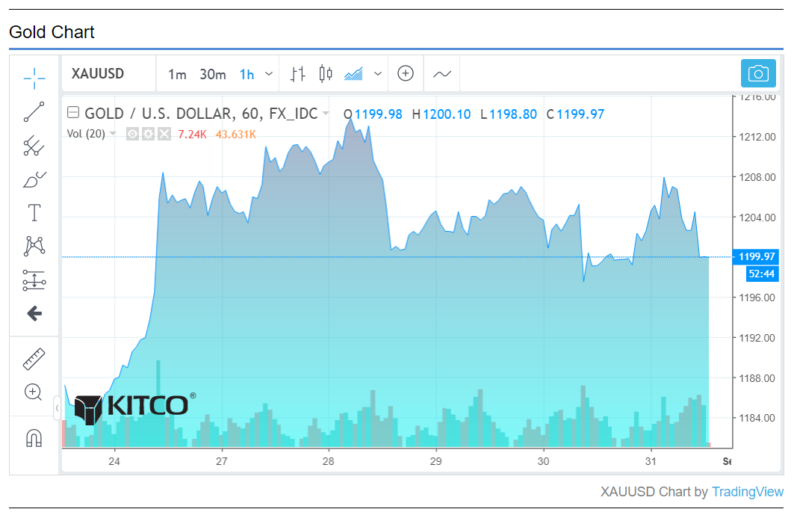

(Kitco News) – With gold heading for its fifth consecutive monthly decline, analysts are looking at the U.S. dollar for direction, adding that the greenback has a solid hold over the precious metal’s prices.

Even though gold is slightly up on the day, with December Comex gold futures last trading at $1,206.30, up 0.11%, the yellow metal is still going to mark its longest monthly losing streak since 2013, down more than 2% over the last 30 days.

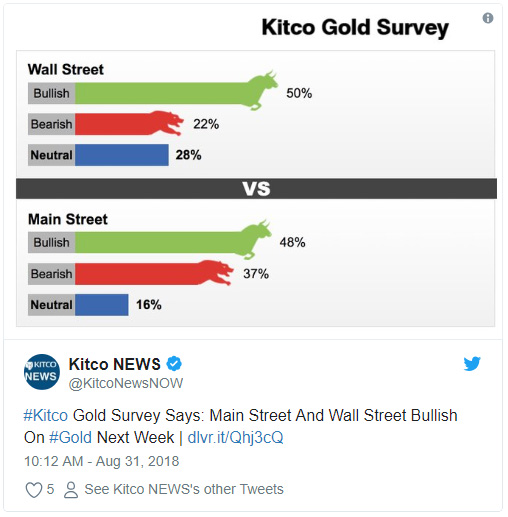

With the debate on whether bottoms are in for gold raging on, analysts remain hopeful that the yellow metal can see higher prices next week.

“I don’t think there is evidence that a bottom is in place, but we can rebound a bit further,” London Capital Group head of research Jasper Lawler told Kitco News on Friday. “There is scope for a bit more of a recovery. If we can close above $1,200, recovery is possible to $1,235.”

Lawler is among many analysts who see the U.S. dollar as the primary driver for gold prices in the near term. “The gold unfortunately at the moment is 99% the U.S. dollar,” he said.

Even though the U.S. dollar has come down a bit in the past couple of weeks, it could still appreciate and weigh on gold, warned Capital Economics analyst Simona Gambarini.

“We don’t expect the dollar to weaken much this year, which is why we don’t expect gold to move much from current levels,” Gambarini said.

The U.S. dollar index began to climb again on Friday, rising to 95.05 and putting additional downward pressure on gold.

“The dollar edged higher against a basket of major currencies during early trade, as US-China trade tensions boosted its safe-haven appeal. With the U.S. economy growing faster than initially estimated during the second quarter, market expectations remain elevated over a rate hike in September,” said FXTM research analyst Lukman Otunuga.

The Federal Reserve is also linked to the U.S. dollar outlook, Gambarini added. “We expect two more rate hikes this year, which should be negative for gold prices.”

Although the list of negatives for gold is extensive, Lawler pointed to a few positive factors, highlighting geopolitical ramblings in Italy and Turkey as well as adding that “the U.S. President Donald Trump is looking a bit politically unstable at the moment.”

Lawler also said that the stock market’s new highs could be good for gold, referring to the rally as a possible “false breakout.”

“It’s a good sign that even with stock market breaking out to new highs, gold is still holding onto the $1,200 level,” he said.

Trade Rhetoric

Trade tensions are also on everyone’s mind, with investors especially eyeing the next round of the U.S.-China trade conflict following U.S. President Donald Trump’s comments on his readiness to support tariffs on $200 billion in Chinese imports as soon as next week, according to Bloomberg.

What this means for gold depends on how the situation develops, said Gambarini.

“If trade tensions deteriorate and trigger some safe-haven demand into the dollar, that could be negative for gold prices,” she said. “But, if tensions do come off from current levels and there is a deal between the U.S. and China, we could see the dollar depreciate.”

The U.S. dollar is attracting safe-haven buying amid these disputes, while EM currencies continue to struggle.

“The Turkish lira is grabbing all the attention, but the global backdrop is negative for all of EM. This backdrop of higher U.S. rates, heightened trade tensions, and slowing growth in China is expected to persist well into 2019,” Brown Brothers Harriman said in a note on Friday.

The effect on emerging market gold demand is also significant to consider in all of this, added Gambarini.

“If the dollar doesn’t weaken much, you would still see gold prices in local currency be quite high, limiting demand for gold,” she said.

Levels To Watch

TD Securities head of global strategy Bart Melek expects gold to rise slightly next week, with resistance around $1,214 and support at $1,184.

“This U.S. dollar rally will probably top out a little bit. Markets are likely to start worrying about equity performance amid this angst in emerging markets. Less robust equity markets and lower yields are good for gold,” Melek said.

Lawler pointed out that next week is the U.S. Labor day long weekend, which means thinner trading. “The $1,235 an ounce level is the potential upside target, with $1,180 being a key rebound level. We would need to hold here to see a bigger bounce,” he said.

Price volatility is likely to pick up as summer break comes to an end, added Lawler.

“For a while, gold was pretty lateral. $1,200 is a big line in the sand and people are trying to either pick-up on a bounce or recover their positions. The drop in itself is forcing people to take positions and that should mean prices bouncing around,” he explained.

Key Data

The most significant market release next week will be the U.S. employment report, scheduled for Friday, with a strong August figure potentially putting pressure on gold.

“After a 157k gain in nonfarm payroll employment in July, a somewhat stronger report than the headline reading suggests, we expect a solid 215k increase in NFP employment in August,” analysts at Nomura Global Economics wrote.

Next week will also feature a number of Federal Reserve speakers, including Chicago Fed President Charles Evans, New York Fed President John Williams and Federal Reserve Bank of Minneapolis President Neel Kashkari.

Other macro data on the docket next week are the Bank of Canada rate decision, the U.S. Manufacturing PMI and the ADP Nonfarm Employment report.

By Anna Golubova

For Kitco News

Contact agolubova@kitco.com

www.kitco.com